NYSEMSCI a leading provider of researchbased indexes and analytics will be releasing the results of its Annual Market Classification Review on June 20 2018. June 16 2021.

China A Shares What Have We Learned Msci

The first inclusion step will coincide with the May 2019 Semi-Annual Index Review.

Msci market classification 2018. Since September 2019 international institutional investors have been subject to the imposition of capital controls in the Argentina equity market. For more than 40 years MSCI. Market accessibility aims to reflect international institutional investors experience of.

MSCI MARKET CLASSIFICATION FRAMEWORK. MSCI MARKET CLASSIFICATION FRAMEWORK. MSCI a leading provider of global equity indexes announced today that beginning in June 2018 it will include China A shares in the MSCI Emerging Markets Index and the MSCI ACWI Index.

Results of MSCI 2018 Market Classification Review. In todays announcement MSCI also said that it will include the MSCI Saudi Arabia Index in its 2018 Annual Market Classification Review for a potential inclusion in the MSCI Emerging Markets Index. The first inclusion step will coincide with the May 2019 Semi-Annual Index Review.

This consultation may or may not lead to. MSCI to Announce 2018 Market Classification Review New York June 13 2018 MSCI Inc. 27 Zeilen The Annual Market Classification Review is based on the MSCI Market Classification.

MSCI to Announce 2018 Market Classification Review New York June 13 2018 MSCI Inc. The current MSCI Market Classification Framework consists of the following three criteria. MSCI Argentina Index reclassification to Standalone Markets status.

Sustainability of economic development. Results of MSCI 2018 Market Classification Review MSCI Will Include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index MSCI Will Reclassify the MSCI Argentina Index to Emerging Markets Status MSCI to Consult on the Potential Reclassification of the MSCI Kuwait Index to Emerging Markets Status. MSCI Will Include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index MSCI Will Reclassify the MSCI Argentina Index to Emerging Markets Status MSCI to.

The Global Industry Classification Standard GICS is an industry taxonomy developed in 1999 by MSCI and Standard Poors SP for use by the global financial community. MSCI also announced today that the MSCI Argentina Index will not be reclassified to Emerging Markets. MSCICOM PAGE 2 OF 5 MSCI Market Classification Framework December 2018 The size and liquidity requirements are based on the minimum investability requirements for the MSCI Global Standard Indexes.

LONDON-Thursday 21 June 2018 AETOS Wire BUSINESS WIRE -- MSCI. Company significantly diversified across three or more sectors none of which contributes the majority of revenues or earnings is classified either in the Industrial Conglomerates sub-industry Industrials Sector or the Multi-Sector Holdings sub-industry Financials Sector. MSCI Will Include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index MSCI Will Reclassify the MSCI Argentina Index to Emerging Markets Status.

A leading provider of researchbased indexes and. At that time it also announces markets to be reviewed for potential market reclassification in the upcoming cycle. New York June 20 2017 MSCI Inc.

Each June MSCI communicates its conclusions based on discussions with the international investment community on the list of markets under review. MSCI announced today that it will reclassify the MSCI Argentina Index from Emerging Markets to Standalone Markets status in one step coinciding with the November 2021 SemiAnnual Index Review. Consultation on potential methodology enhancements.

The GICS structure consists of 11 sectors 24 industry groups 69 industries and 158 sub-industries into which SP has categorized all major public companiesThe system is similar to ICB Industry Classification Benchmark. Bloomberg the Company Its Products The Company its Products Bloomberg Terminal Demo Request Bloomberg Anywhere Remote Login Bloomberg Anywhere Login Bloomberg Customer Support Customer Support. Read the Press Release.

Finally MSCI today also released the 2018 Global Market Accessibility Review for the 84 markets it covers. Economic development size and liquidity and market accessibility. RESULTS OF MSCI 2018 MARKET CLASSIFICATION REVIEW MSCI will include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index MSCI will reclassify the MSCI Argentina Index to Emerging Markets status MSCI to consult on the potential reclassification of the MSCI Kuwait Index to Emerging Markets status.

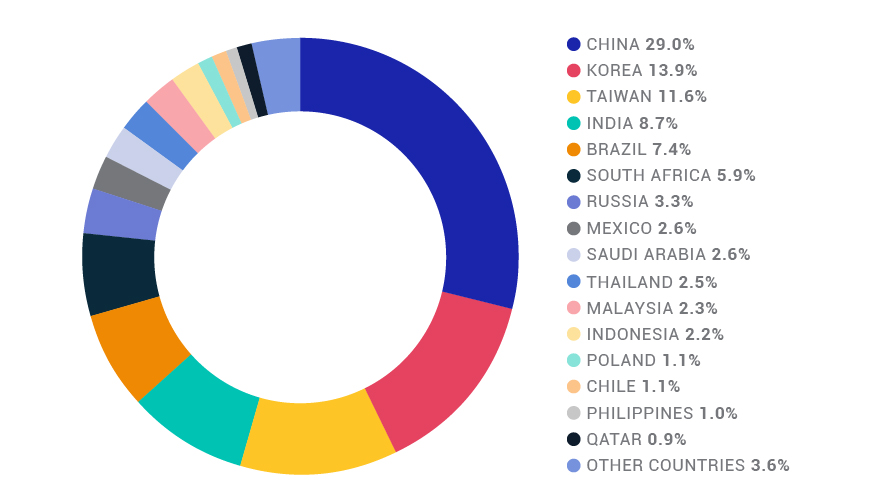

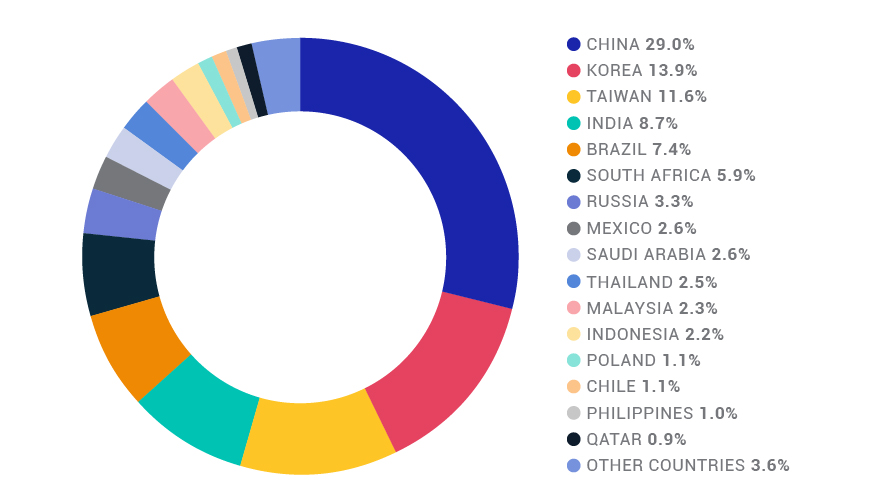

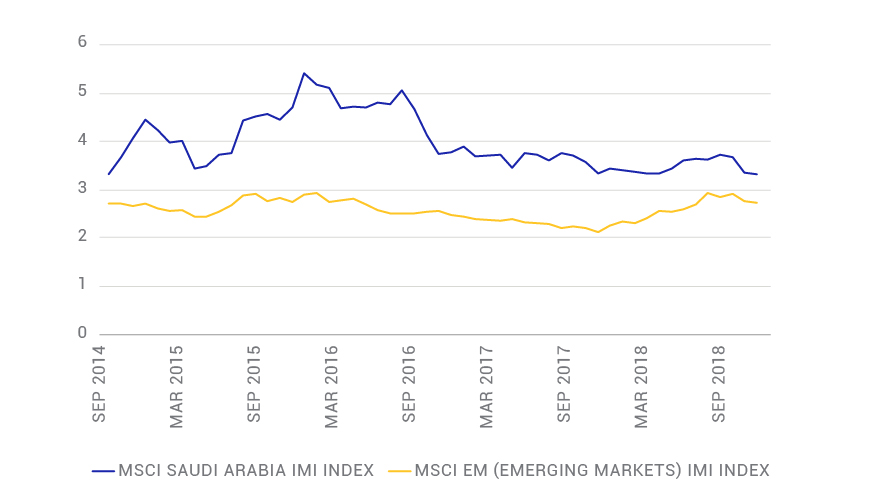

The second step will take place as part of the August 2019 Quarterly Index. The second step will take place as part of the August 2019 Quarterly Index. MSCI will include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index representing on a pro forma basis a weight of approximately 26 of the index with 32 securities following a two-step inclusion process.

July 9 2021. Market accessibility conditions which is a key factor in MSCIs classification framework. MSCI will include the MSCI Saudi Arabia Index in the MSCI Emerging Markets Index representing on a pro forma basis a weight of approximately 26 of the index with 32 securities following a two-step inclusion process.

Retire In Progress Etf List 2019 Part 2 World

The Requirements For Emerging Markets Index Inclusion Insurance Asset Management Schroders

Transition Strategies Around Msci Country Reclassifications

Msci Emerging Markets Wikipedia

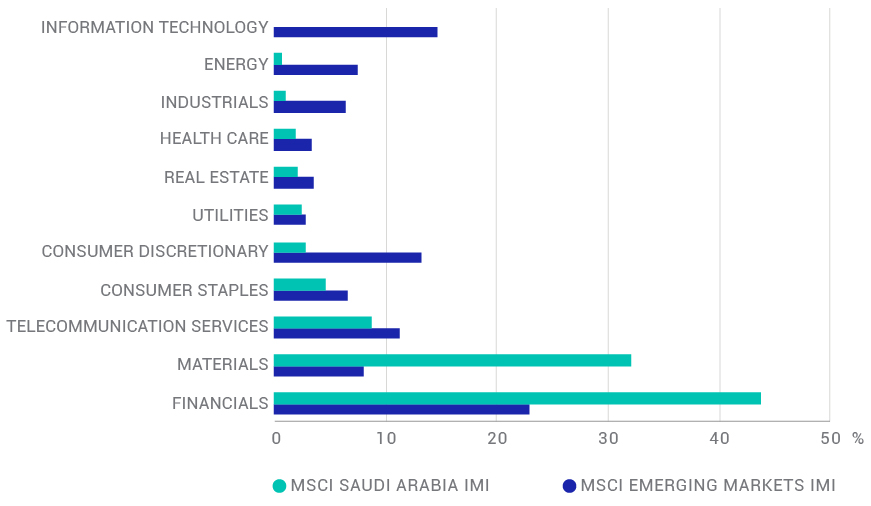

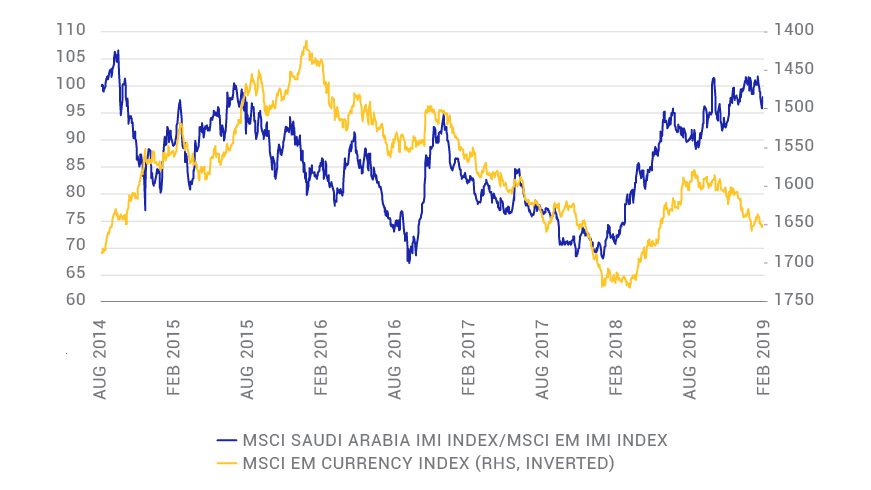

Saudi Arabia Inclusion And Emerging Markets Msci

Saudi Arabia Likely To Be Included In Msci Emerging Market Index Businesskorea

Iceland Included In The Msci Frontier Markets Index Fossar Markets

Transition Strategies Around Msci Country Reclassifications

Saudi Arabia Inclusion And Emerging Markets Msci

Saudi Arabia Inclusion And Emerging Markets Msci

Saudi Arabia Inclusion And Emerging Markets Msci

Classifications Of Stock Markets A Developed Markets B Emerging Download Scientific Diagram

Saudi Arabia Likely To Be Included In Msci Emerging Market Index Businesskorea

How Emerging Markets Have Changed Over The Past 20 Years Particulieren Schroders

How Emerging Markets Have Changed Over The Past 20 Years Particulieren Schroders

Msci Emerging Markets Emea Index

List Of Market Indices Of Each Classification As Listed By Msci Download Scientific Diagram

What S The Difference Between Frontier And Emerging Markets Ekonamik